What a difference a year makes.

Every year, the city’s annual financial statement shows the condition of the city’s finances.

Last year, the one for the fiscal year ending Sept. 30, 2018, was released on March 29.

Mayor Lenny Curry wrote in it, “As I have learned from my experience in the private sector, you can tell a lot about the values, priorities and leadership of an organization by examining its finances. Since day one, my administration has committed to bold, innovative and disciplined fiscal management practices and solutions that enable us to better invest in key priorities for our city. This Comprehensive Annual Financial Report highlights our unwavering promise to be responsible stewards of taxpayer resources. To earn and maintain public trust, we must ensure that every dollar is invested wisely, and maximizes benefits for our community.

“Because of the important work of many dedicated public servants, Jacksonville is in its strongest financial position in years. In this first term, our collaborative work and efforts solved Jacksonville’s long-standing pension crisis, paid down $376 million in municipal debt, and earned the first AAA credit rating in City history.”

The most recent report, now nearly two months late in being released, may not be as rosy, especially as it pertains to the pension funds. They had been a recurring concern before Curry unveiled a plan that he said would fix the problem.

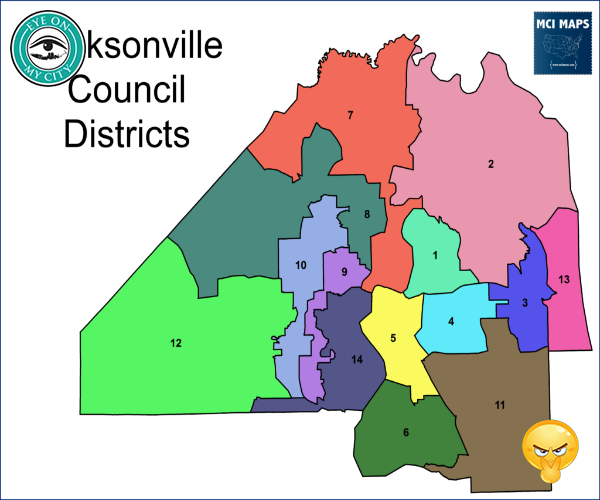

Three years ago, Curry got the City Council to approve his plan to address the deficit in the city’s three pension funds.

It relied upon growth, and a new tax that would take effect in 2030.

However, most people now expect the Chinese virus to have a drastic effect, not only on the national economy but also to state and local government revenues.

Economic growth is going to decline as the federal government plunges into debt and the new local sales tax may not produce the anticipated results.

In a recent notice, the general employees fund trustees said the city contributions to the pension funds may have to increase to make up for investment (market) losses and lower than projected ½-cent sales tax revenue “but we have to wait for the various reports which will come out again next March or April (2021).”

As the unfunded liability of the pension plans increases, the city contribution will have to increase. That will leave less money for the city to use on other priorities.

At City Haul, they say the delay in the report is the result of a combination of the virus problem and a computer software problem.

We asked for a comparison of the original projections compared to the actual, and got this answer:

“We discontinued tracking this as we did not end up using the savings from pension reform to fund the pay increases like we had held them aside for because City revenues grew sufficiently. Those funds now reside in our General Fund reserves and have strengthened the City’s finances. We no longer track them separately.”

That is bafflegab.

One financial expert jokingly told Eye that he fed the city’s response into Google Translate and got, in standard English, “We realized we had stepped into one giant pile of s*** so we’re changing the subject and covering up the evidence.”

Curry’s pension reform uses anticipated future tax collections to reduce the amount the city must contribute to the fund annually. That frees up money the city can use for other purposes.

Up until now.

The plans are facing huge losses. This will increase the unfunded liability both from less investment income and from insufficient sales tax revenue in the future.

The most recent actuarial report for the police and fire fund noted:

“We are unable to assess the risk that the timing and/or amount of future pension liability surtax proceeds may significantly deviate from the projections (due to legal challenges, economic hardships, or any other reason). Any such deviations could have a significant impact on the required contribution amount shown herein and on the future solvency risk that the Fund’s future assets may be insufficient to cover all future benefit payments.”

No one could have seen the Chinese virus coming or anticipated the federal government’s draconian response.

But the Curry pension plan overhaul always was a gamble and it appears that might not be a successful one.

Fortunately, because the plan will take 40 years to complete there is plenty of time for correction of the plan’s assumptions, which are critical to projections, and for markets to improve.