Here are two facts about the local government finances:

Mayor Lenny Curry is not “cutting taxes.”

The budget Curry is proposing to the City Council is not $1.55 billion.

This is not nit-picking, it is clarifying information that is important.

When the local government send out a tax bill, it is based on two factors: the tax rate set by the council and the value of the property.

If one of those factors increases and the other stays the same, the bill is higher.

Therefore, if the local government leaves the tax rate the same but the value of your home increases, your tax bill is higher. (2 x 2 = 4; 2 x 3 = 6)

With the collective appraised value of homes increased by some $10 billion this year over last, the same tax rate would mean $100 million more for the government.

Curry is proposing a very slight reduction in the tax rate but the rate he proposes still would be enough to add about $80 million to the city’s coffers.

There is a law called the TRIM law that requires local governments to tell the state what the tax rate would have to be to produce the same amount of money as the previous year for existing property. New property added to the tax roll is excluded. That means the government would get more money even at the rolled-back rate because of the growth.

The tax rate Curry proposes would be well above the rollback rate set in the TRIM notice. Therefore it is an increase in taxes.

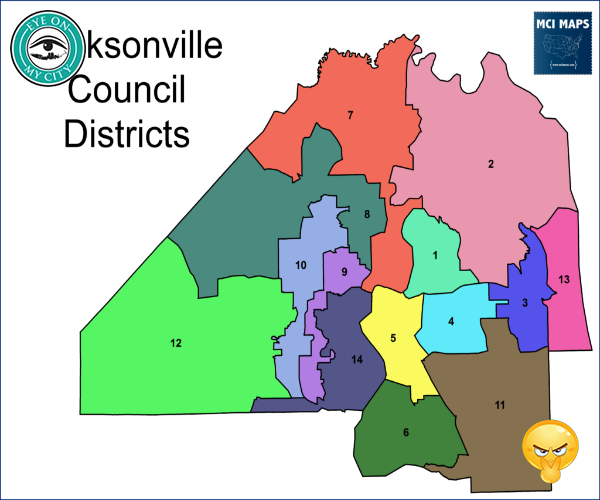

Another piece of information concerns the city’s budget. Curry, who funnels all information through a gatekeeper, has the local media conditioned to report one part of the city’s budget – the general fund — as “the city budget.” It is less than half the total budget.

Curry is an accountant. He knows better. And he knows it matters. To his credit, he isn’t claiming he is cutting taxes, as the media says. He correctly calls it a “reduction in our city’s property tax rate.”

While businesses that use the ports pay fees, virtually all the money that is spent by local government ultimately comes from the taxpayers.

For example, JEA hands over more than $100 million every year to the central government “in lieu of taxes.” Who pays that? Ratepayers, who also are Jacksonville taxpayers.

The state and federal government also give the city money, generally with restrictions on how it must be spent. There are also other local taxing authorities, and school taxes are separate as well.

The full city budget last year was $3.46 billion. Including the budgets of the independent authorities, which must be approved by the mayor and council, brings the total to $6.5 billion.

These numbers are not hidden, despite Curry’s penchant for information control. On Page 11 of his current budget is this:

“TOTAL FOR ALL GENERAL GOVERNMENT FUNDS (2021) 2,961,380,591 (2022) 3,453,656,141.“

That’s right. Spending went up a half-billion dollars this year, without including the independent authorities.

The corresponding figure in Curry’s budget for next year is $3,822,882,877.