Jacksonville is a seller’s market right now when it comes to homes, but buyers must be pretty wealthy.

Thanks to Bidenomics, the cost of homes has risen and –also thanks to Bidenomics — the cost of financing them has soared into the stratosphere.

(Bidenomics: the belief that you continually can spend Other People’s Money without regard for need and without actually having the money.)

Florida is the fastest-growing state in the nation and Tampa is the hot spot for real estate.

Florida’s rapid population growth is putting a strain on the housing supply. Additionally, the Sunshine State is a popular destination for retirees and second-home buyers, which is also driving up demand for housing.

As a result, Florida home values have risen by about 80% over the past five years.

Jacksonville came in at No. 6 on Zillow’s ranking of the hottest real estate markets of 2023, two spots ahead of Miami.

The average cost of a home sold in Jacksonville during the past year is $297,412, an increase of nearly $2,000 year-to-year.

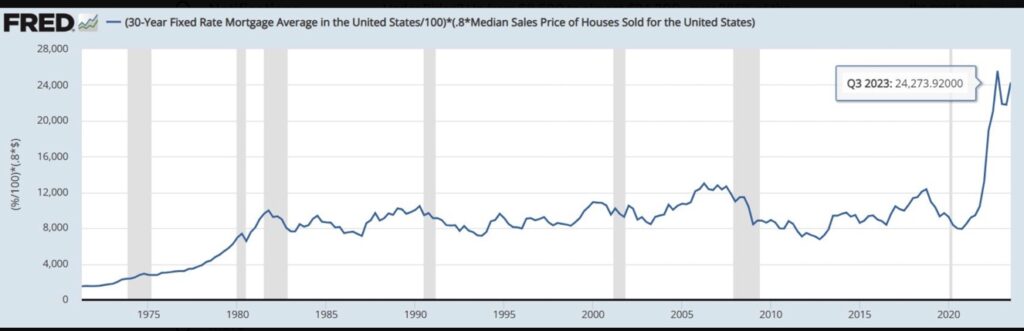

Mortgage rates are around 8 percent. This is well above the average for decades before the Biden administration embarked on a wild spending spree, without money to pay for it.

Biden’s insatiable spending has added $7.5 trillion in debt. Libs says it was because of the cost of saving lives during the pandemic, which is nonsense. Less than 10 percent of that spending was related to the Red Chinese virus.

Many of the newcomers to the state are affluent residents of blue states, fleeing high taxation. They can afford to pay for more-costly housing, but less-affluent residents of the state face not only the higher prices but the brutal interest rates on their mortgages.

For them the rising value of homes is not good news.

To comfortably afford today’s mortgage payments, a typical homebuyer would need an annual salary of $119,500—nearly double the actual median household income of $64,240, according to realtor.com.

Richard Stern of the Heritage Foundation put it in perspective. He tweeted that from President Ronald Reagan through Donald Trump, mortgage payments were stable. Under Biden they are up more than 285 percent since Trump was president, Stern said.

It is laughable for Democrats to drone on about the need for “affordable housing” when they are the main cause of housing being unaffordable.