The Associated Press covered a transformational story under the headline, “‘Trump Accounts’ for kids just got a $6B boost. How can you claim one?” “It’s an IRA for kids,” explained tax advisor Evan Morgan. Yesterday, billionaire computer maker Michael Dell donated $6.25 billion to seed 25 million kids’ accounts with $250 each.

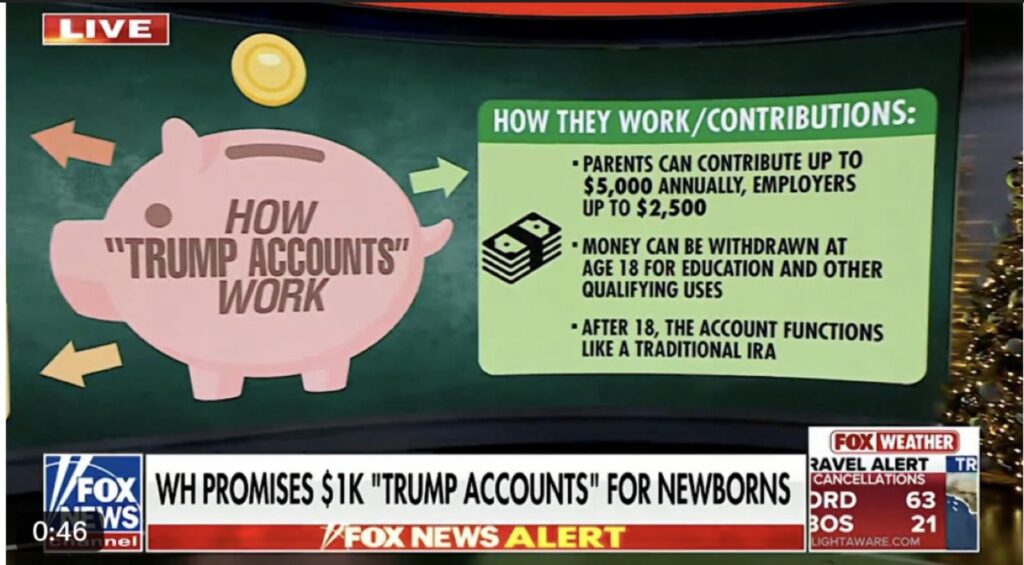

Under the program, established in President Trump’s One Big Beautiful Bill, any child with a Social Security number born between 2025 and 2028 will receive a baby shower gift from Congress and President Trump: a $1,000 deposit into a “Trump Account.”

Now, thanks to Mr. Dell’s donation, it’s grown to $1,250. During the announcement, President Trump also said he planned to solicit other business leaders to donate more money to Trump Accounts. How high can he go?

Trump Accounts are automatically invested in low-cost stock index funds that track market indices, such as the S&P 500. Parents and employers can contribute up to $5,000 a year into the accounts until the child turns 18. After 18, it acts like an IRA, but kids can withdraw money without penalties for things like college education or buying a first home. At age 59.5, funds can be withdrawn for any reason.

Trump originally designed the accounts to be fully available to kids reaching young adulthood. But the Senate restructured the bill into something more like a conventional IRA (which illustrates the risks of legislation to Trump’s short-term agenda).

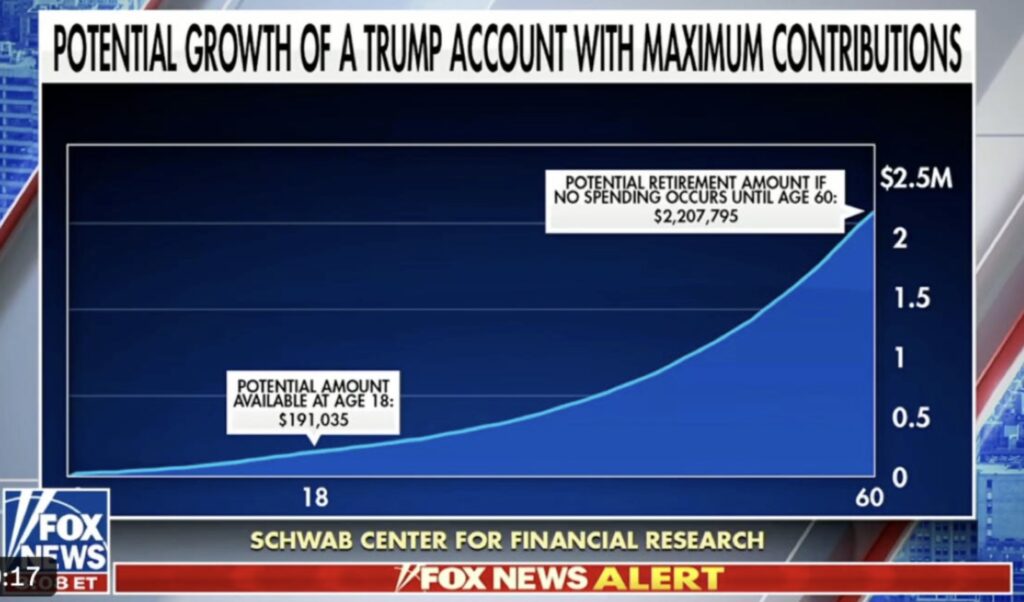

A Fox Business analyst calculated that even with Dell’s or others’ donations, the accounts could grow to $200,000 by age 18, and to $2.25 million by retirement, assuming kids (and their parents and employers) keep putting money in. But it will also grow significantly even without additional money, since time in the market is the best driver of growth.

CLIP: Fox News Business analysis on Trump accounts (0:25).

This is good for Main Street —even kids with poor parents become stock owners at birth— and it’s also good for Wall Street, since the additional demand will support stronger stock prices, and will juice index fund providers. Win-win!