For most people, a home is the largest expense in their lives.

Over the past decade, housing prices in Jacksonville generally have been on the rise, part of a broader national trend. The median home price in Jacksonville has increased significantly.

In 2013, the median home price was around $150,000. By 2023, it had risen to approximately $300,000. Factors such as population growth, economic development, and a strong demand for housing account for the growth.

If your income keeps pace with the cost, that’s not a problem. Has it?

U.S. Census Bureau data on median household income does show an upward trend over the same decade.

In 2013, the median household income in Jacksonville was about $47,000. By 2023, it had increased to around $60,000.

But buying a $150,000 house with a $47,000 income and buying a $300,000 house with a $60,000 income is not the same.

The Real Cost of Borrowing

That, however, is not the entire story.

If you borrow the money to buy a house you must pay it back, with interest.

Around 2013, the average 30-year fixed mortgage rate was approximately 3.5% to 4.5%. Rates dipped in 2020 and 2021, with averages around 2.7% to 3.1% because of economic measures taken during the pandemic. However, rates began to rise again in 2022 and 2023, reaching around 5% to 6% as the Federal Reserve adjusted rates.

So the price of the house doubled while income did not, and the cost of a mortgage almost doubled.

And Then There Are Property Taxes

You also have to pay property taxes.

Markets set the cost of housing and salaries, but politicians set property taxes.

Over the same decade, the average effective property tax rate in Jacksonville has been around 1% to 1.2% of the property’s assessed value. That assessed value, however, has risen, as noted above.

As a result, the local government took in nearly a billion dollars in property taxes in 2023, up from $447 million in 2013 — more than doubling.

Affordable for Whom?

Politicians talk a lot about “affordable housing,” but what do they do about it?

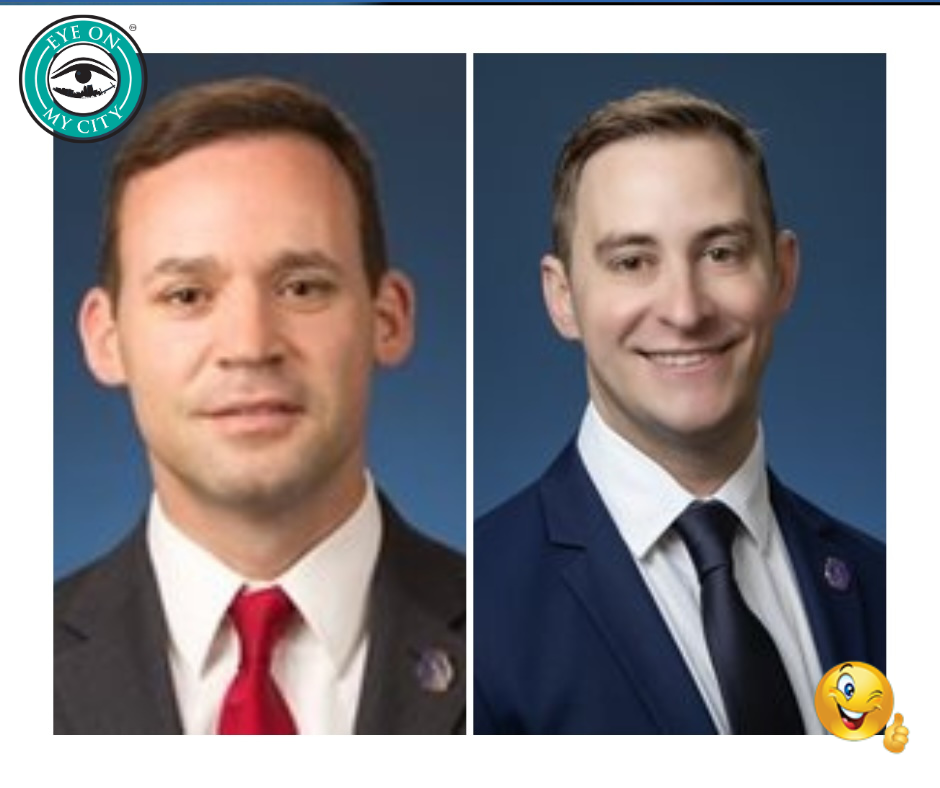

Last month, the City Council increased property taxes, although it was a smaller increase than the mayor wanted.

Affordable housing is a meaningless term. Every home is affordable to someone, but no home is affordable to someone without an income.

Increasing taxes does not make homes more affordable – except for those who are favored by getting special subsidies on their home purchase, using money other people have paid in taxes.

What makes homes less affordable is government. Taxes, regulations and inflation – all government products – increase the cost of homes.

The Question That Matters

The next time you hear a politician pontificating about affordable housing, ask:

“Are you going to vote for lower property taxes?”