Forbes ran a story headlined, “Musk Mulls Sending All Americans $5,000 Checks Using DOGE Savings.” It’s another “somebody said something” story. Elon responded positively to somebody else’s tweet proposing “DOGE Dividend” to give taxpayers a refund check of $5,000 funded by the DOGE savings. In other words, some of our money back.

The tweet’s bare suggestion triggered everyone. Progressive wailed about the national deficit (one of the few times it offends them). Conservatives complained about the national debt.

But … is there something there?

One of the most mysterious and least discussed executive orders that Trump signed during his first week in office created a “Sovereign Wealth Fund.” At the time, he suggested it might have something to do with TikTok. He said, “We’re going to have a sovereign wealth fund… and we might put that in the sovereign wealth fund,” referring to potential investments like TikTok.

The President also speculated the fund could be financed through tariffs and by monetizing un-named federal assets. Treasury Secretary Scott Bessent has mentioned general plans to “monetize the asset side of the U.S. balance sheet for the American people.”

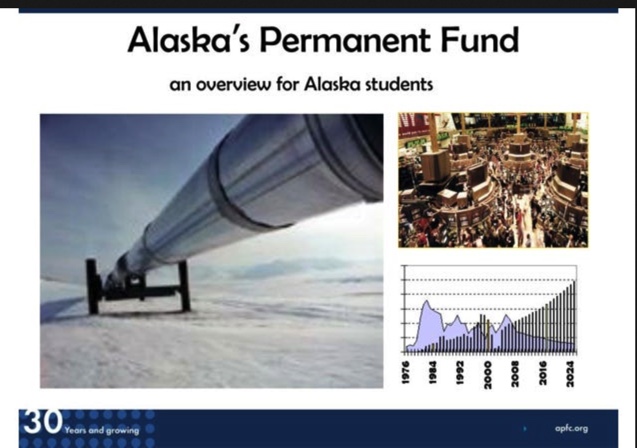

Readers have asked me what I make of the Sovereign Wealth Fund. I don’t know. It is fascinating. It reminds me of Alaska’s Permanent Fund (APF).

In 1976, Alaska amended its state constitution to create the APF, which receives 25% of all royalties from oil and mineral revenues. The funds are partially used for long-term state benefits. But part of it is rebated—directly—to eligible Alaskans every single year.

It’s basically a negative state income tax.

Alaskans don’t just “pay into” the system—they get a cut of the profits from their state’s resources. In this sense, Alaskans share in the state’s publicly-owned oil and mineral revenues, giving residents direct participation in benefits derived from the state’s natural resources.

The rebate varies depending on each year’s royalty revenue. In 2024, Alaskans got a rebate check of $1,403. In 2022, they got $3,284. The principal of the fund is earmarked for Alaskans. The interest is used for rebates and government spending, but only with specific legislative approval. The salutary effect is that Alaskans are arguably more invested in state government than citizens anywhere else, because they have a direct financial stake in its management.

What if Trump’s Sovereign Wealth Fund is a national version of Alaska’s APF?

Could federal assets, tariffs, and TikTok revenues create a perpetual fund that pays Americans directly? Could it function like a national dividend, giving citizens a stake in America’s wealth? Could it reduce individual tax burdens by directing federal revenues to be rebated instead of just spent?

The details remain murky. But President Trump is notorious for teasing big ideas before they drop. A Fort Knox audit. A Sovereign Wealth Fund. DOGE Savings. A potential dividend? I have no better idea where this is going than anyone else.

But I strongly suspect it’s bigger than just a Fort Knox inventory check.

What if Trump moved our jointly-owned gold into the Sovereign Wealth Fund? What if revenues from federal assets were allocated to the SWF instead of just swelling useless agency spending and enhancing dark, off-books budgets? What if those funds were invested and professionally managed for profit and revenue?

It could be head-spinningly huge.

What if President Trump is completely rethinking federal wealth management?

I don’t know. But I think, whatever it is, it’s going to be a titanically triggering hum-dinger. And they’ll never see it coming.