I told you so! For months, Trump has been chipping away at the income tax. No taxes on tips here, no taxes on Social Security there. Now he’s finally, quietly, without details, letting the media do the work, come all the way out into the open. The New York Times ran a potentially world-changing story yesterday that nobody noticed, headlined, “Trump Flirts With the Ultimate Tax Cut: No Income Taxes at All.

It is finally all coming together and making sense. Tax cuts and tariffs, as explained in the article’s subheadline: “The former president has repeatedly praised a period in American history when there was no income tax, and the country relied on tariffs to fund the government.”

Holy checking account, Batman.

Of course, the New York Times took the unpopular position of defending the income tax. In a word: fairness. The Times says that funding the federal government through tariffs isn’t fairenough, since it doesn’t soak “the rich” more than everybody else. (It feels so sinister when actual rich people like the owners of the New York Times argue in favor of soaking “the rich” through income taxes, which they do not pay, since their money derives from capital gains, but I digress.)

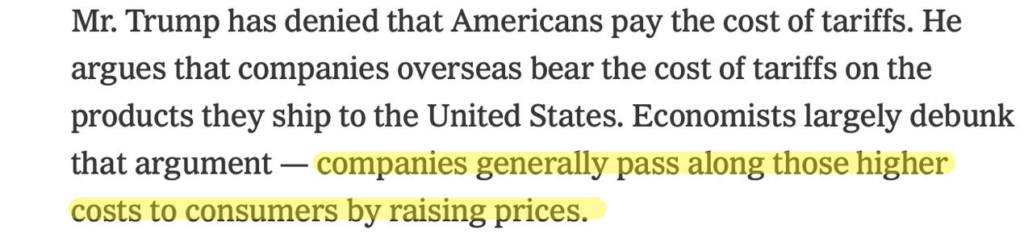

Tariffs are taxes. But suddenly, after being confronted with Trump’s plan, the New York Times has miraculously discovered that, get this, corporations pass taxes along to customers. I’d almost given up hope. This is also the entire argument for ending inflationary corporate taxation, but I digress:

So … Kamala’s plan to increase the corporate tax rate will also increase prices. In other words, her plan will accomplish the exact opposite of lowering inflation. Noted. Thanks, New York Times, for the helpful admission!

The cowardly Times disabled the comments section for this story.

But now, you can see the whole thing. Perhaps this is Trump’s October surprise, the unplayed card that Trump held in reserve (and is still keeping the details close to his chest). End the income tax and fund the federal government through tariffs. So simple. Even if it did result in higher prices for foreign goods and services (encouraging domestic alternatives, by the way), it would just be a sales tax.

As Trump pointed out, this can easily work. We’ve run the country this way before, for a long time. This is exactly how we used to do it. The proposal is simple, elegant, and practical. But economists never thought of it, which is why they’ll oppose it.

Only President Trump could have proposed something so radical and right.

Experts and economists will be badly triggered by all this talk of tariffs. They get obsessed with tariffs in a very Rain Man-ey sort of way. Maybe tariffs do impose some external costs. But there is no possible way to calculate the offsetting, galactic-sized boost our economy would experience from drastically reducing or eliminating the hated, productivity-killing income tax.

Nobody saw this coming. Media will do everything it can to suppress it. But Trump’s plan could produce the greatest economic boom this country has ever seen, a thousand times bigger than the gold rush. Only Trump could pull it off. It’s incredibly encouraging.