Apparently, oversight can become meddling at some point, depending on the eyes of the beholder.

In November 2020, Duval County voters accepted a half-cent sales tax increase, by a vote of 2-to-1.

The money was to replace aging schools.

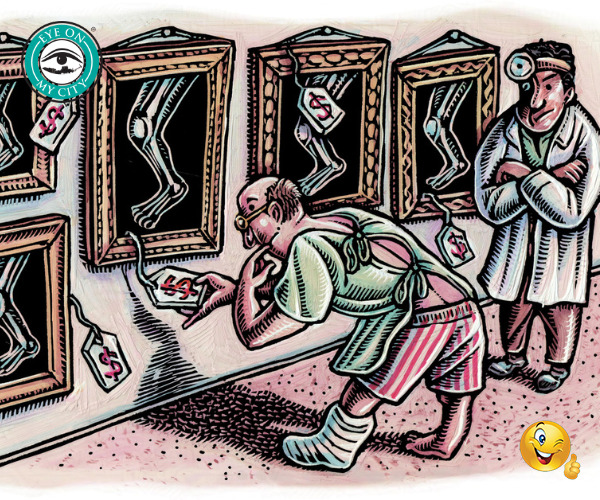

But the referendum also created an oversight committee to track the spending.

The question on the ballot was: “To upgrade aging schools through repairs and modernization, to keep schools safe and to continue to promote a conducive learning environment, to improve technology, and to replace existing or build new schools, and share with charter schools for their allowable uses, shall the Duval County School Board be authorized to levy a 15-year half-cent sales surtax, with expenditures based upon the Surtax Capital Outlay Plan, and monitored by an independent citizens committee?”

As it turns out, the independent committee voters authorized was not to be as independent as some might have thought.

When the committee began asking questions the school administration did not like, the district’s lawyer ruled that the committee was not entirely independent.

Don Green, chairman of the committee, thereupon resigned.

Meanwhile, the district is hemorrhaging students to private schools, charter schools and home schooling and the half-cent sales tax is not going to produce enough money to do what the district planned because “Bidenflation” is driving up costs. It is about $45 million over budget and envisions a $1.4 billion shortfall.

Since it doesn’t have enough students to fill the schools, the district is planning to close older and smaller schools. Because neighborhoods have sentimental attachments to those schools, there is a lot of unhappiness. The district is holding neighborhood meetings in an effort to sell its plan.

The oversight committee objected to Florida law regarding charter school finances and issued a resolution calling upon the legislature to “prepare and adopt legislation in the current legislative session to require charter schools receiving voter-approved, voluntary sales surtax funds to provide the public with a detailed accounting of all expenditures made with those funds from the date the funds were initially received by the school.”

Green said the not-for-profit companies operating charter schools can use money they get in one district– including funds from the half-cent sales tax — for expenses in another district and the committee could not track that money in the periodic reports and annual audits of the companies.

The School Board objected to the committee asking for legislation, specifically saying the committee was not allowed to set policy.

Green told Eye on Jacksonville the committee was not setting policy; it was asking the board, which is the policy making body, to send the committee’s resolution to the lawmakers.

Green appeared before the board and read the resolution. The board changed the existing policy so that it declares committee not a policy-making entity, and did not send the resolution to the legislators or governor.